En uno de los intensivos sobre analítica de BI del coach, escuché la declaración: "La analítica de BI crea valor para la empresa, pero es imposible determinar el valor del equivalente monetario de este valor".

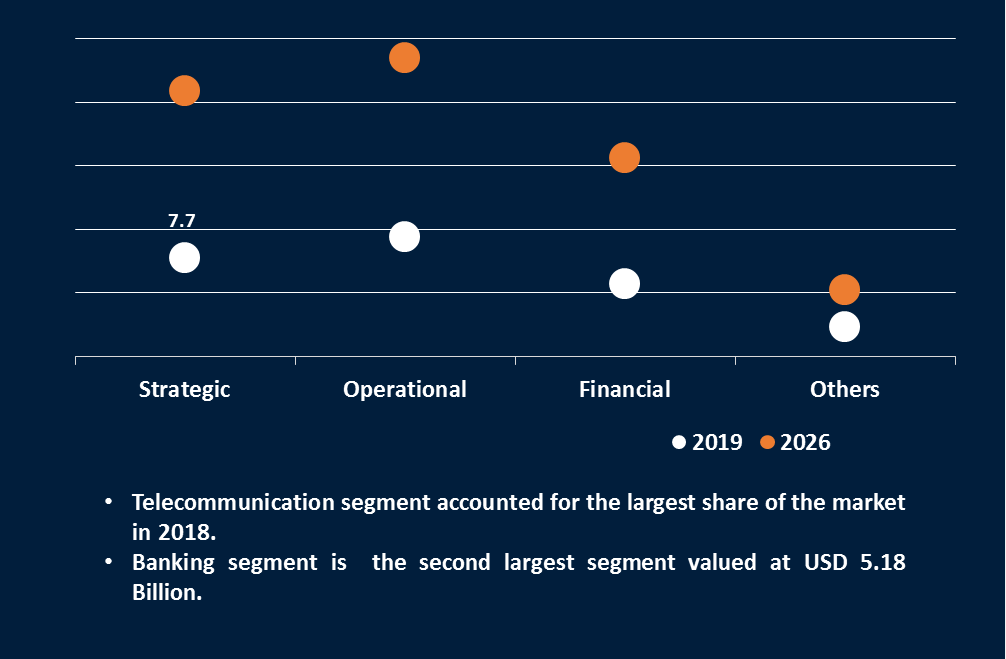

No estuve de acuerdo con esta afirmación porque, en mi opinión, la administración crea un sistema de métricas de análisis de negocios para ver los vectores del desarrollo empresarial y los problemas ocultos que conducen a una disminución en el resultado final. Y si es difícil concretar el vector de desarrollo con la ayuda de métricas, los fenómenos de crisis se identifican de manera bastante confiable, con un estudio cualitativo de datos históricos. Es decir, se manifiesta la función explícita del espacio de métricas, mostrando las zonas en las que una empresa preferiblemente no debe caer y el sistema de métricas de negocio es una herramienta de gestión de riesgos. Por el momento, las tecnologías para monetizar las actividades de gestión de riesgos están bien establecidas. Asimismo, el recurso "Informes y Datos" predice el volumen del mercado de análisis de riesgo para el 2026 por un monto de 65 mil millones de dólares.

, , The Hong Kong University of Science and Technology . , , - - .

«The 19 Best Risk Management Software of 2021».

, - -.

Business intelligence in risk management: Some recent progresses (2014 )

, , . - , -. -, , , .

: -, , .

1.

: - . , . , , , 11 2001 ., , , , .

H1N1 , (59).

, , , -, . - , -. , , , , (38, 2, 36). - (27, 34). - , (59). - , .

, - .

2.

. . , , . . , . , , , . . , , (57). , , (50, 14). , (37).

(54). , (13). , , (45). . , Jorion (26) : - , - - . , Olson and Wu (45).

: .

- , , . , , , . , , . , , , , .

- : , , , . (3); . . 1700- , , , . . 1930- , , . . , . , , .

, .

- . , , , , . , . , , , , , . (OR) .

, - .

3.

, , , , , , , . , , . , .

3.1.

. Krstevska (30) . . Flores (15) . Castell and Dacuycuy (9) . Hua (23) , . Xie et al. (61) .

3.2.

- , , , . Schneidewind (51) , . Jin and Zhang (25) , , , - . , (62), 2008 . , Groth Muntermann (20), , . (12) .

3.3.

1970- (28,56) Warenski (58) , - . Otim et al. (46) , . , . Kozhikode and Li (29) , . , (44), . Silvestri et al. (53) . Lakemond et al. (32) , .

3.4.

Nash (42), . . Zhao and Jianq (63) , . Merrick and Parnell (39) - , . . Lin et al. (35) -, , . Gnyawali and Park (19) .

3.5.

- . Gurny Tichy (21) . Chen et al. (11) , Six Sigma DMAIC .

Wu and Olson (60) , . Caracota et al. (8) , . Poon (48) (Freddie Mac Fannie Mae), , .

3.6. Data mining

Data mining . Shiri et al. (52) , , . Jans et al. (24) , , , . Holton (22) , . Nateghi et al. (43) data mining , , . Ghadge et al. (17) . . (5, 41)

3.7. -

, , . Smeureanu et al. (55) -. Giannakis and Louis (18) , , , . , . Caporale et al. (7) , . , Chang Lee et al. (10) Kumar et al. (31) . , . Mizgier et al. (40) - , - .

3.8.

. (4) . , . . Ahmadi and Kumar (1) , - . Buurman et al. (6) , , . Popovic et al. (49) , .

3.9. data mining

- , , -. , , . . Folino et al. (16) , , , . . Li et al. (33) .

4.

, , , : - , - - . : Kansei, , , .

« ERP FCM», Cristina Lopez and Jose Salmeron, (ERP). , (FCM) ERP. FCM . , . ERP , . , FCMS . , - ERP . - ERP.

Hybrid Kansei-SOM Model using Risk Management and Company Assessment for Stock Trading, Hai Pham, Eric Cooper, Thang Cao Katsuari Kamei, Kansei, . , . Kansei , . Kansei . Kansei SOM , , .

HOSE, HNX (), NYSE NASDAQ (). , Kansei . , , , .

« : - », Nan Feng, Harry Jiannan Wang, and Minqiang Li, - , . (BN) - . , . SRAM BN . SRAM .

«Calibration of the Agent-based Continuous Double Auction Stock Market Scaling Analysis», Yuelei Li, Wei Zhang, Yongjie Zhang, Xiaotao Zhang, and Xiong, (CDA) . Pasquini and Serva. (47) CDA, , , . , , , , .

5.

- . . , , - , .

, Patrick Paulson, Karl Leung, Colin Johnson, Daniel Zeng, Guo H. Huang, Chuen-Min Huang, Ching Huei Huang, Xiaoding Wang, Chichen Wang, Guixiang Wang, Cheng Wang, Magnus Johnsson, Guangquan Zhang, Futai Zhang, and David Mercie.

W. Pedrycz, P. P. Wang . NSC 101-2410-H-004-010-MY2.

References

1 A. Ahmadi, U. Kumar, Cost based risk analysis to identify inspection and restoration intervals of hidden failures subject to aging, IEEE Transactions on Reliability 60 (1) (2011) 197–209.

2. E. Alfaro, N. Garcia, M. Gamez, D. Elizondo, Bankruptcy forecasting: an empirical comparison of AdaBoost and neural networks, Decision Support Systems 45 (1) (2008) 110–122.

3. M. Baucells, F.H. Heukamp, Probability and time tradeoff, SSRN working paper, 2009. http://ssrn.com/abstract=970570

4. Y. Ben-Haim, Doing our best: optimization and the management of risk, Risk Analysis: An International Journal 32 (8) (2012) 1326–1332.

5. M. Bevilacqua, F.E. Ciarapica, G. Giacchetta, Data mining for occupational injury risk: a case study, International Journal of Reliability, Quality & Safety Engineering 17 (4) (2010) 351–380.

6. J. Buurman, S. Zhang, V. Babovic, Reducing risk through real options in systems design: the case of architecting a maritime domain protection system, Risk Analysis: An International Journal 29 (3) (2009) 366–379.

7. G.M. Caporale, A. Serguieva, H. Wu, Financial contagion: evolutionary optimization of a multinational agent-based model, Intelligent Systems in Accounting, Finance & Management 16 (1/2) (2009) 111–125.

8. R.C. Caracota, M. Dimitriu, M.R. Dinu, Building a scoring model for small and medium enterprises, Theoretical & Applied Economics 17 (9) (2010) 117–128.

9. M.R.F. Castell, L.B. Dacuycuy, Exploring the use of exchange market pressure and RMU deviation indicator for early warning system (EWS) in the ASEAN+3 region, DLSU Business & Economics Review 18 (2) (2009) 1–30.

10. K. Chang Lee, N. Lee, H. Li, A particle swarm optimization-driven cognitive map approach to analyzing information systems project risk, Journal of the American Society for Information Science & Technology 60 (6) (2009) 1208–1221.

11. Y.C. Chen, S.C. Chen, M.Y. Huang, C.L. Tsai, Application of six sigma DMAIC methodology to reduce financial risk: a study of credit card usage in Taiwan, International Journal of Management 29 (2012) 166–176.

12. F. Ciampi, N. Gordini, Small enterprise default prediction modeling through artificial neural networks: an empirical analysis of Italian small enterprises, Journal of Small Business Management 51 (1) (2013) 23–45.

13. D. Dalcher, Why the pilot cannot be blamed: a cautionary note about excessive reliance on technology, International Journal of Risk Assessment and Management 7 (3) (2007) 350–366.

14. A.L. Fletcher, Reinventing the pig: the negotiation of risks and rights in the USA xenotransplantation debate, International Journal of Risk Assessment and Management 7 (3) (2007) 341–349.

15. C. Flores, Management of catastrophic risks considering the existence of early warning systems, Scandinavian Actuarial Journal 2009 (1) (2009) 38–62.

16. G. Folino, A. Forestiero, G. Papuzzo, G. Spezzano, A grid portal for solving geoscience problems using distributed knowledge discovery services, Future Generation Computer Systems 26 (1) (2010) 87–96.

17. A. Ghadge, S. Dani, R. Kalawsky, Supply chain risk management: present and future scope, International Journal of Logistics Management 23 (3) (2012) 313–339.

18. M. Giannakis, M. Louis, A multi-agent based framework for supply chain risk management, Journal of Purchasing & Supply Management 17 (1) (2011) 23–31.

19. D.R. Gnyawali, B. Park, Co-opetition and technological innovation in small and medium-sized enterprises: a multilevel conceptual model, Journal of Small Business Management 47 (3) (2009) 308–330.

20. S.S. Groth, J. Muntermann, Intraday market risk management approach based on textual analysis, Decision Support Systems 50 (4) (2011) 680–691.

21. P. Gurny, T. Tichy, Estimation of future PD of financial institutions on the basis of scoring model, in: 12th International Conference on Finance & Banking: Structural & Regional Impacts of Financial Crises, 2009, pp. 215–228.

22. C. Holton, Identifying disgruntled employee systems fraud risk through text mining: a simple solution for a multi-billion dollar problem, Decision Support Systems 46 (4) (2009) 853–864.

23. Y. Hua, On early-warning system for Chinese real estate, International Journal of Marketing Studies 3 (3) (2011) 189–193.

24. M. Jans, N. Lybaert, K. Vanhoof, Internal fraud risk reduction: results of a data mining case study, International Journal of Accounting Information Systems 11 (1) (2010) 17–41.

25. X.H. Jin, G. Zhang, Modelling optimal risk allocation in PPP projects using artificial neural networks, International Journal of Project Management 29 (5) (2011) 591–603.

26. P. Jorion, Risk management lessons from the credit crisis, European Financial Management 15 (5) (2009) 923–933.

27. N. Julka, R. Srinivasan, I. Karimi, Agent-based supply chain management-1: framework, Computers & Chemical Engineering 26 (12) (2002) 1755–1769.

28. P.G.W. Keen, M.S. Scott Morton, Decision Support Systems: An Organizational Perspective, Addison-Wesley, Reading, MA, 1978.

29. R.K. Kozhikode, J. Li, Political pluralism, public policies, and organizational choices: banking branch expansion in India, 1948–2003, Academy of Management Journal 55 (2) (2012) 339–359.

30. A. Krstevska, Early warning systems: testing in practice, IUP Journal of Financial Risk Management 9 (2) (2012) 7–22.

31. S.K. Kumar, M.K. Tiwari, R.F. Babiceanu, Minimisation of supply chain cost with embedded risk using computational intelligence approaches, International Journal of Production Research 48 (13) (2010) 3717–3739.

32. N. Lakemond, T. Magnusson, G. Johansson, et al, Assessing interface challenges in product development projects, Research-Technology Management 56 (1) (2013) 40–48.

33. L. Li, J. Wang, H. Leung, C. Jiang, Assessment of catastrophic risk using Bayesian network constructed from domain knowledge and spatial data, Risk Analysis: An International Journal 30 (7) (2010) 1157–1175.

34. W. Liang, C. Huang, Agent-based demand forecast in multi-echelon supply chain, Decision Support Systems 42 (1) (2006) 390–407.

35. M. Lin, X. Ke, A.B. Whinston, Vertical differentiation and a comparison of on-line advertising models, Journal of Management Information Systems 29 (1) (2012) 195–236.

36. P. Lin, J. Chen, FuzzyTree crossover for multi-valued stock valuation, Information Sciences 177 (5) (2007) 1193–1203.

37. K.S. Markel, L.A. Barclay, The intersection of risk management and human resources: an illustration using genetic mapping, International Journal of Risk Assessment and Management 7 (3) (2007) 326–340.

38. D. Martens, B. Baesens, T. Van Gestel, J. Vanthienen, Comprehensible credit scoring models using rule extraction from support vector machines, European Journal of Operational Research 183 (3) (2007) 1466–1476.

39. J. Merrick, G.S. Parnell, A comparative analysis of PRA and intelligent adversary methods for counterterrorism risk management, Risk Analysis: An International Journal 31 (9) (2011) 1488–1510.

40. K.J. Mizgier, S.M. Wagner, J.A. Holyst, Modeling defaults of companies in multistage supply chain networks, International Journal of Production Economics 135 (1) (2012) 14–23.

41. S. Murayama, K. Okuhara, J. Shibata, H. Ishii, Data mining for hazard elimination through text information in accident report, Asia Pacific Management Review 16 (1) (2011) 65–81.

42. J. Nash, Equilibrium points in n-person games, Proceedings of the National Academy of Sciences 36 (1) (1950) 48–49.

43. R. Nateghi, S.D. Guikema, S.M. Quiring, Comparison and validation of statistical methods for predicting power outage durations in the event of hurricanes, Risk Analysis: An International Journal 31 (12) (2011) 1897–1906.

44. D.L. Olson, Decision Aids for Selection Problems, Springer, NY, 1996.

45. D.L. Olson, D. Wu, Enterprise Risk Management Models, Springer, 2010.

46. S. Otim, K.E. Dow, V. Grover, J.A. Wong, The impact of information technology investments on downside risk of the firm: alternative measurement of the business value of IT, Journal of Management Information Systems 29 (1) (2012) 159–194.

47. M. Pasquini, M. Serva, Multiscale behaviour of volatility autocorrelations in a financial market, Economics Letters 65 (3) (1999) 275–279.

48. M. Poon, From new deal institutions to capital markets: commercial risk scores and the making of subprime mortgage finance, Accounting, Organizations & Society 34 (5) (2009) 654–674.

49. V.M. Popovic, B.M. Vasic, B.B. Rakicevic, G.S. Vorotovic, Optimisation of maintenance concept choice using risk-decision factor – A case study, International Journal of Systems Science 43 (10) (2012) 1913–1926.

50. L.A. Reilly, O. Courtenay, Husbandry practices, badger sett density and habitat composition as risk factors for transient and persistent bovine tuberculosis on UK cattle farms, Preventive Veterinary Medicine 80 (2-3) (2007) 129–142.

51. N. Schneidewind, Applying neural networks to software reliability assessment, International Journal of Reliability, Quality & Safety Engineering 17 (4) (2010) 313–329.

52. M.M. Shiri, M.T. Amini, M.B. Raftar, Data mining techniques and predicting corporate financial distress, Interdisciplinary Journal of Contemporary Research in Business 3 (12) (2012) 61–68.

53. A. Silvestri, F. De Felice, A. Petrillo, Multi-criteria risk analysis to improve safety in manufacturing systems, International Journal of Production Research 50 (17) (2012) 4806–4821.

54. D.H. Smaltz, R. Carpenter, J. Saltz, Effective IT governance in healthcare organizations: a tale of two organizations, International Journal of Healthcare Technology Management 8 (1/2) (2007) 20–41.

55. I. Smeureanu, G. Ruxanda, A. Diosteanu, C. Delcea, L.A. Cotfas, Intelligent agents and risk based model for supply chain management, Technological & Economic Development of Economy 18 (3) (2012) 452–469.

56. R.H.J. Sprague, E.D. Carlson, Building Effective Decision Support Systems, Prentice-Hall, Englewood Cliffs, NJ, 1982.

57. G. Suder, D.W. Gillingham, Paradigms and paradoxes of agricultural risk governance, Internat Journal of Risk Assess Manage 7 (3) (2007) 444–457.

58. L. Warenski, Relative uncertainty in term loan projection models: what lenders could tell risk managers, Journal of Experimental & Theoretical Artificial Intelligence 24 (4) (2012) 501–511.

59. D. Wu, D.L. Olson, Introduction to the special section on ‘‘optimizing risk management: methods and tools, Human and Ecological Risk Assessment 15 (2) (2009) 220–226.

60. D. Wu, D.L. Olson, Enterprise risk management: coping with model risk in a large bank, Journal of the Operational Research Society 61 (2) (2010) 179–190.

61. K. Xie, J. Liu, H. Peng, G. Chen, Y. Chen, Early-warning management of inner logistics risk in SMEs based on label-card system, Production Planning & Control 20 (4) (2009) 306–319.

62. M. Yazici, Combination of discriminant analysis and artificial neural network in the analysis of credit card customers, European Journal of Finance & Banking Research 4 (4) (2011) 1–10.

63. L. Zhao, Y. Jiang, A game theoretic optimization model between project risk set and measurement, International Journal of Information Technology & Decision Making 8 (4) (2009) 769–786.

, BI- , - , .

BI-, , . BI- .

, . : « , ?» , , . : «» - , «» - , .

, , , , , - . , . , , , .

«Reports and Data» 2026 65 ..

, , :

2028 118,09 ..;

volumen de mercado de motores alternativos para automóviles en 2027 por un monto de 541,53 mil millones de dólares.